The past few days has set me thinking about why I ended where I am now; A below-average salaried worker struggling to achieve financial independence.

I became extremely demoralised after realising that most of my peers (especially my fiancee!) are earning at least 30% more than me. I got even more despondent when I read about how bloggers around my age have amassed much more wealth than me!

Thoughts just ran wild in my head as I pondered about why I am earning significantly less. Finally, I realised why.

"Life had offered me choices and I always took the easy way out.".

All my life, I have been taking the easy way out and not the path that rewards me the most. I was always being plain lazy and have set low standards for myself. When life posed challenges, I aim to achieve the minimum requirements as I wanted to put in as little effort as possible. Eventually, I just failed to challenge myself in life and have fallen into a life of mediocrity!

Education

Well, let me starts from my primary education. In primary school, I was consistently one of the top performers in class all thanks to my mother. She had a very effective way of teaching me and getting me to do my homework via the CSB method (

Caning,

Shouting,

Beating).

Hence, it was no surprise that I was a top student because I was putting in the effort!

Slowly, my mother grew weary of teaching me (the nightly shouting and caning sessions can be exhausting). Moreover, she was not highly educated and she did not have the capability to guide me in my studies once I progressed beyond Primary 4.

Without her watching over my studies, I started to slack and I was no longer submitting my homework on a regular basis. Within 1 year, I have fallen behind in class and was no longer a top student.

During PSLE, I was even watching TV programs the whole day before my exams. Luckily, I managed to obtain a rather respectable PSLE result and life presented me with my

first major choice!

Do I choose to go to a top school further away, without my close friends and where standards will be higher? Or do I choose a neighborhood school closer to home where most of my close friends will also be entering?

I could have choose the top school instead which might have presented me with a tougher but more rewarding journey in life.

Instead, I chose the neighborhood school as I could sleep more without all the travelling. How immature. The easy way out.

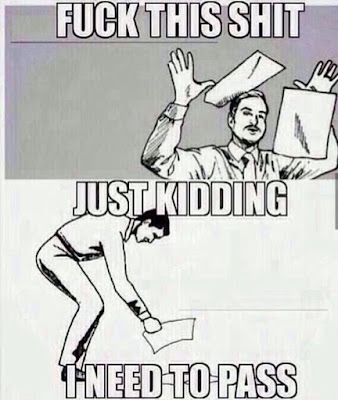

In secondary school, I had total freedom from my mother and a free rein over my own studies! I became even lazier and was consistently the weaker students in class. All I wanted was to get promoted to the next level every single year. Hence, I studied just enough to pass my exams every time.

When it comes to my education after "O" level, I took the

easy way out again. I decided to select a polytechnic education as I heard that it'll be more fun. I could have study harder and scored well enough to take the JC-University route. However, since I choose the easier polytechnic route, I studied just enough during my "O" levels to scrape through and enter the polytechnic.

During my polytechnic education, I scored extremely well during my 1st semester despite aiming to pass my exams only. I could have still enter the university if I manage to maintain the standard.

However,

I took the easy way out once again.

I decided to put in less effort in my studies since it seems easy to score well.

And that is how I ended up where I am now. Aged 27 years old, armed with just a diploma with sub-par results, and struggling in my part-time studies to earn my degree.

And I am certainly aware that what I am doing is only just sufficient to catch up with some of my peers who have put in the necessary hard work in their education, and hence, earning at least 30% more than me now.

Even if I have completed my part time education, I will still be earning less compared to some of them who have degrees from the more reputable schools.

Education is indeed important. A tad too late for me to realise it:(

Career

Beside my education, I took the easy way out in my career too.

During one of my previous job stint, I was rather looked upon favourable by my boss. Moreover, I was learning a great deal in my work. While promotion was not a certainty, a career there does look promising. However, I found the workload heavy.

When I was "promised" an opportunity to earn more in a sales related position, with an increase of a measly $130, I jumped at the opportunity.

Fast forward 2 years later, and I have returned to my former job. To my great disappointment, I realise that my former colleagues from 2 years ago have progress well in this company, while I am back to square one.

The irony. And they say job hopping is a good career move.

I guess all these events are part of life. However, I resolve never to let mediocrity ruin my life any more further.

Step one: I shall strive to complete my part-time degree as soon as possible, with respectable grades.

Step two: Continue to give my best in my current job, and not quit unless the other position offer at least 25% more.

Step three: Continue to put away at least $600 and all my bonus for my investment portfolio.

Step four: Start up a new project to start a new business (some sorta delivery/transportation business)

NEVER EVER LET MEDIOCRITY EXIST IN YOUR LIFE. Set high standards for yourself or you will live to regret.